What Is Bookkeeping? (From First Principles)

Before understanding AI bookkeeping, it helps to know what bookkeeping itself means.

At its core, bookkeeping is the process of recording every financial transaction in your business, such as:

- Sales and income

- Expenses and bills

- Bank transactions

- Payroll entries

- Taxes owed or paid

Traditionally, this meant:

- Manually entering data into spreadsheets or accounting software

- Categorizing transactions one by one

- Reconciling bank statements at month-end

- Sending data to an accountant after everything happened

Bookkeeping isn’t about strategy it’s about accuracy and consistency. And that’s exactly why automation fits so well here.

What Is AI Bookkeeping?

AI bookkeeping uses machine learning, rules engines, and automation to handle bookkeeping tasks automatically, with minimal human input.

Instead of manually logging every transaction, AI-powered systems can:

- Pull transactions directly from bank feeds

- Automatically categorize income and expenses

- Detect duplicates, anomalies, or missing entries

- Reconcile accounts in near real time

- Continuously learn from past behavior to improve accuracy

In short, AI bookkeeping replaces repetitive human data entry with intelligent automation.

Many modern platforms such as Elmmetric focus on this approach by combining automation with accounting logic, giving businesses clean books without making the process feel complex or “finance-heavy.”

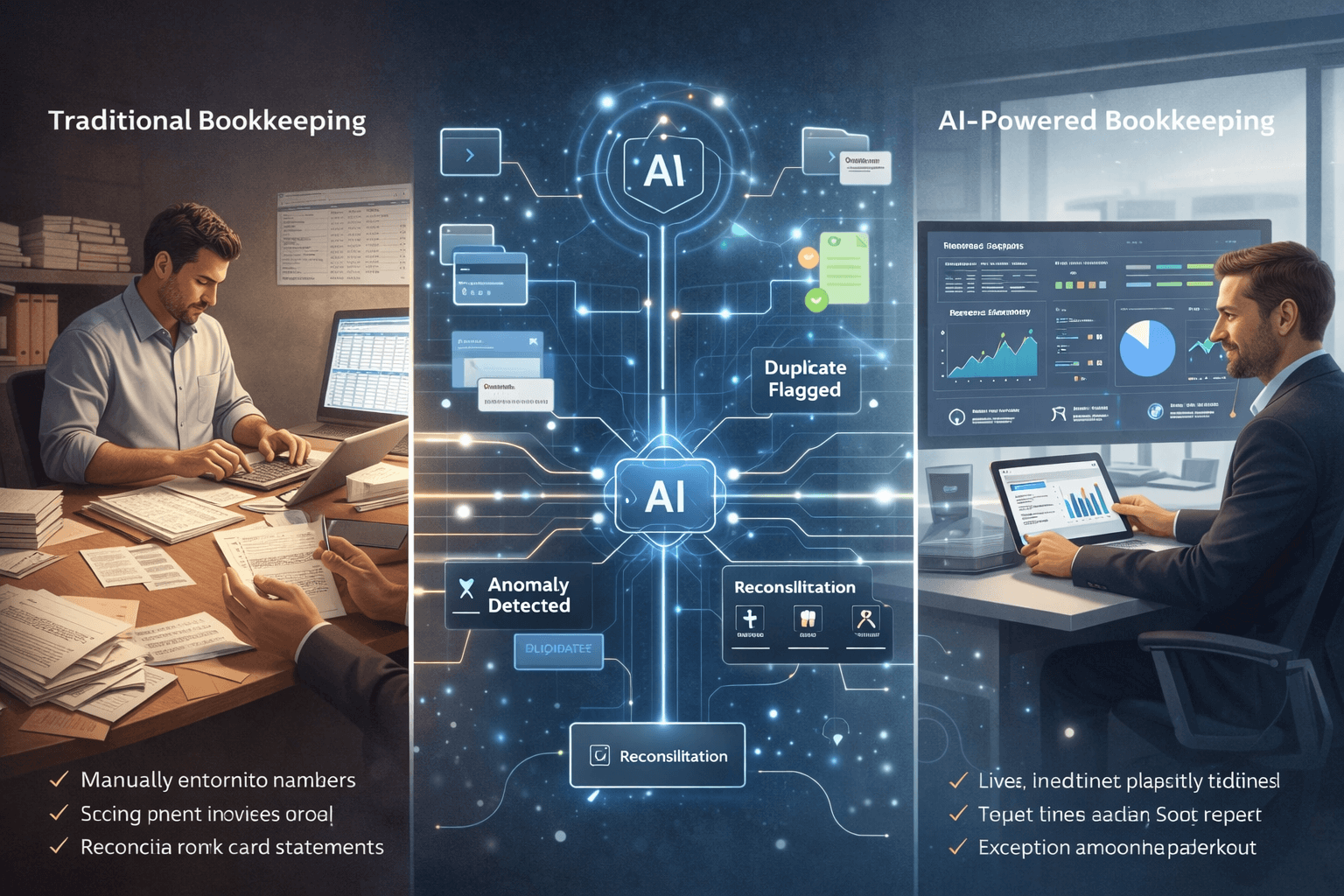

Traditional Bookkeeping vs AI-Powered Bookkeeping

Here’s a practical comparison to make the difference clear:

Traditional Bookkeeping

- Manual data entry or semi-manual uploads

- Monthly or quarterly updates

- Higher risk of human error

- Delayed visibility into cash flow

- Heavy dependence on accountants or bookkeepers

- Stressful tax-season catch-up

AI-Powered Bookkeeping

- Automatic transaction syncing

- Real-time or near real-time updates

- Consistent categorization using AI models

- Always-on financial visibility

- Lower operational cost over time

- Fewer surprises during audits or tax filing

The shift isn’t just about speed it’s about confidence and control.

How Does AI Bookkeeping Actually Work?

AI bookkeeping systems typically follow this flow:

1. Automated Data Collection

The software connects securely to your:

- Bank accounts

- Credit cards

- Payment gateways

- Invoicing tools

Transactions flow in automatically, without uploads or spreadsheets.

2. Smart Categorization

AI models analyze:

- Transaction descriptions

- Vendor history

- Past categorization patterns

Based on this, expenses are categorized (e.g., marketing, software, travel) with increasing accuracy over time.

3. Continuous Reconciliation

Instead of reconciling once a month, AI systems:

- Match transactions continuously

- Flag mismatches or missing entries

- Reduce end-of-month workload

4. Exception Handling

Rather than reviewing everything, humans only step in when:

- Transactions look unusual

- Amounts fall outside normal ranges

- Compliance rules require validation

This “exception-first” approach is what makes bookkeeping automation scalable.

Why AI Bookkeeping Matters Today (2024–2025)

AI bookkeeping isn’t just a nice-to-have anymore. It solves real problems businesses face right now.

1. Manual Data Entry Errors Are Costly

Human entry errors can lead to:

- Incorrect tax filings

- Missed deductions

- Compliance penalties

According to industry studies cited by accounting bodies like the AICPA, manual processes remain one of the biggest sources of financial inaccuracies. AI dramatically reduces this risk through consistency and pattern recognition.

2. Businesses Need Real-Time Financial Visibility

Waiting 30–60 days to know your cash position is no longer viable.

AI bookkeeping gives:

- Up-to-date cash flow insights

- Clear expense trends

- Early warning signs for overspending

This is especially critical for startups and SMBs operating on tight margins.

3. Accounting Costs Are Rising

Hiring full-time bookkeepers or relying heavily on monthly accounting services is expensive.

Bookkeeping automation for small businesses:

- Reduces manual hours

- Lowers recurring accounting costs

- Allows accountants to focus on advisory, not data entry

4. Tax-Season Panic Is Still Very Real

Many businesses scramble at year-end because:

- Books aren’t updated

- Documents are scattered

- Numbers don’t reconcile

With AI bookkeeping, records stay continuously updated making tax filing more predictable and far less stressful.

5. Compliance Requirements Are Increasing

Governments worldwide are tightening reporting and audit standards. Official tax authority guidelines consistently emphasize accurate, timely record-keeping as a compliance requirement.

AI bookkeeping helps maintain audit-ready books year-round, not just once a year.

A Short Real-World Scenario

Scenario:

A 10-person SaaS startup processes hundreds of monthly transactions across subscriptions, cloud services, ads, and tools.

Before AI bookkeeping:

- Founder updates books once every 2 months

- Accountant spends hours cleaning data

- Cash flow surprises happen regularly

After switching to AI bookkeeping:

- Transactions are categorized automatically

- Founder checks a live dashboard weekly

- Accountant focuses on forecasting and tax planning

The result? Better decisions, fewer surprises, and lower finance overhead.

FAQs About AI Bookkeeping

1. Is AI bookkeeping safe and secure?

Yes. Reputable AI accounting software uses bank-grade encryption and follows data protection standards commonly referenced by financial regulators and industry bodies.

2. Does AI bookkeeping replace accountants?

No. It replaces manual bookkeeping tasks, not professional judgment. Accountants become advisors rather than data processors.

3. Is AI bookkeeping suitable for very small businesses?

Absolutely. In fact, small businesses benefit the most due to limited time and resources.

4. How accurate is AI bookkeeping?

Accuracy improves over time as the system learns from corrections and historical patterns. Many platforms reach higher consistency than manual entry.

5. Can AI bookkeeping handle taxes?

AI bookkeeping supports tax preparation by keeping clean records, but tax filing and strategy usually still involve a qualified professional.

6. How long does it take to set up?

Most AI bookkeeping tools can be set up in days, not weeks especially compared to traditional systems.

Who Should Consider AI Bookkeeping?

AI bookkeeping is ideal for:

- Small business owners without finance teams

- Startups scaling transaction volume quickly

- Freelancers and consultants managing multiple income streams

- Businesses tired of last-minute tax chaos

- Founders who want real-time financial clarity

If your business values accuracy, speed, and peace of mind, AI bookkeeping is no longer optional it’s becoming the standard way modern businesses manage their finances.